Improving road safety in Denmark with the white label app

Discover Bilist+ the innovative road safety program launched by LB Forsikring in Denmark in order to reduce road risk and make customers safer on the road.

Smartphone telematics is a reliable and cost-effective technology to support your connected insurance products (Pay-As-You-Drive/Pay-How-You-Drive) and your road safety programs.

Measure road risk

Protect drivers

Launch prevention programs

Engage your community

Reliable and efficient technology

Based on our driving analysis platform, insurers get an accurate understanding of their customers' driving behavior. Our driving insights are objective because they are based on data collected by smartphone sensors, the laws of physics and machine learning.

To deploy our solution, insurers can integrate the DriveKit SDK directly into their application or customise our white-label application.

Unlike traditional telematics devices such as boxes, smartphone telematics is a software-based solution. It's easy to launch at a large scale and doesn't require complex logistics.

Speed up claims management

Be notified within seconds when a policyholder is involved in a road accident, thanks to our accident detection service.

Your operators will be notified less than 20 seconds after the collision. They'll be able to make the best decision: send emergency services or roadside assistance, depending on the severity of the impact.

Engage policyholders with innovative features

In addition to our driving scores, insurers can launch road safety programs based on our connected services.

Insurance companies can launch driving challenges to train their drivers and promote a safer driving style. The drivers will also receive in-app driving tips based on their own driving style to help them identify what can be improved.

Reliable and clear driving scores

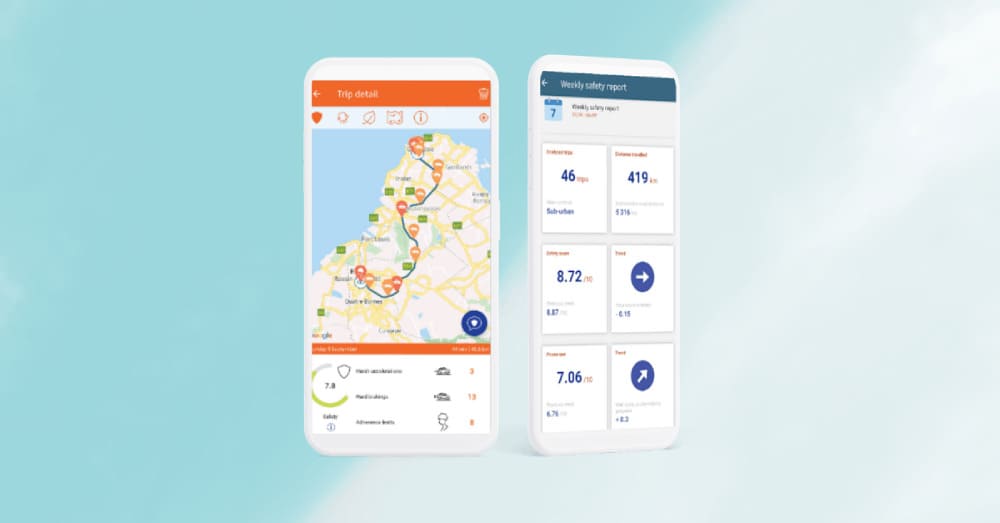

Our driving analysis platform analyses data collected by mobile phone sensors (GPS, inertial unit, accelerometer) and transforms it into driving insights that are representative of road risk.

Our solution provides three driving scores for each trip made: a safety score, a distraction score and an eco-driving score. You are free to use the score or scores that interest you.

To engage users, the driving scores are available in the application within seconds of the end of a trip for users, and in the web Dashboard within seconds of the end of a trip for insurers.

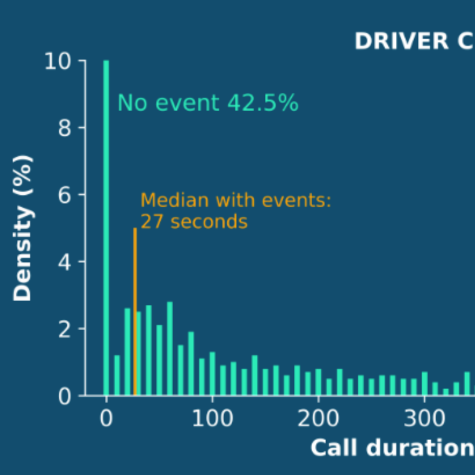

Reducing distracted driving is a top priority for insurers as it causes many accidents. With our driving insights platform, insurer can quickly identify the most distracted drivers and enrol them in prevention programs.

DriveQuant & SCOR provide insurers with a turnkey solution for launching their Pay-How-You-Drive/Pay-As-You-Drive product. Insurers benefit from:

over 10

usage-based and behavior-based insurance programs

2 months

on average to deploy a product on the market

- 30%

of distracted driving after the implementation of the solution

20%

less hard brakings after two months

Improving road safety in Denmark with the white label app

Discover Bilist+ the innovative road safety program launched by LB Forsikring in Denmark in order to reduce road risk and make customers safer on the road.

24/04/2024

Discover

Launch of an eco-driving service for 1 million drivers

Roole managers explain all the benefits brought by DriveQuant smartphone telematics. They use DriveQuant tech to offer eco-driving service to their members

05/05/2023

Discover

Usage-based insurance for short-distance drivers

Altima launched in 2018 pay-per-minute and pay-per-mile insurance based on DriveQuant smartphone telematics for short drivers. The claim ratio is positive.

04/04/2023

Discover

Insuring high-risk drivers with behavioral insurance

Behavioral car insurance insures all drivers, including high-risk drivers such as ride hailing drivers. It benefits both insurers and high risk customers

04/04/2023

Discover

From prevention to Pay-How-You-Drive insurance, Boubyan Takaful

The success of its road prevention program led Boubyan Insurance to transform it into a Pay-How-You-Drive or behavior-based insurance program.

13/06/2022

Discover

Drive By MUA: the insurance app that rewards good driving

Drive by MUA is a road safety prevention program based on smartphone telematics. It is a white label app that analyzes driving style and coaches drivers

26/11/2021

DiscoverDriveQuant is a French insurtech company active in over 15 countries worldwide, and has launched over 60 telematics programs. We are experts in smartphone telematics. We analyze data from phone sensors to measure driving behavior in order to make roads safer and reduce the environmental footprint of mobility.